Crypto summer plan

Crypto winter is over. I will have a look at the market and plan ahead.

Market outlook

NASDAQ weekly

Is is over the weekly 10 EMA? YES

Is is over the weekly 20 EMA? YES

Is is over the weekly 40 MA (= 200 Daily MA)? YES

BITCOIN weekly

Is is over the weekly 10 EMA? YES

Is is over the weekly 20 EMA? YES

Is is over the weekly 40 MA (= 200 Daily MA)? YES

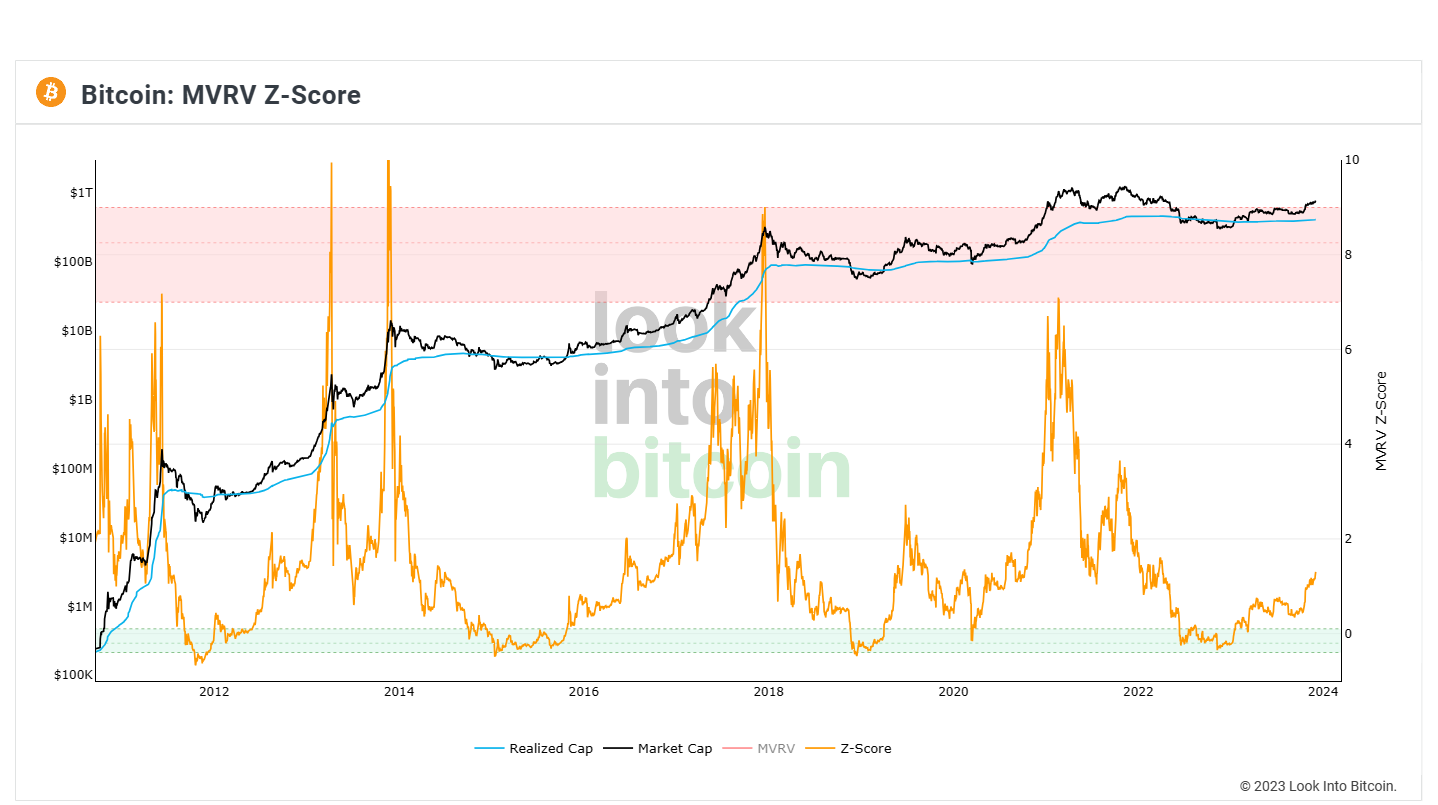

MVRV Z-Score | LookIntoBitcoin

In the past it has been a good oppurtunity buying Bitcoin in the green zone and to sell in the red zone.

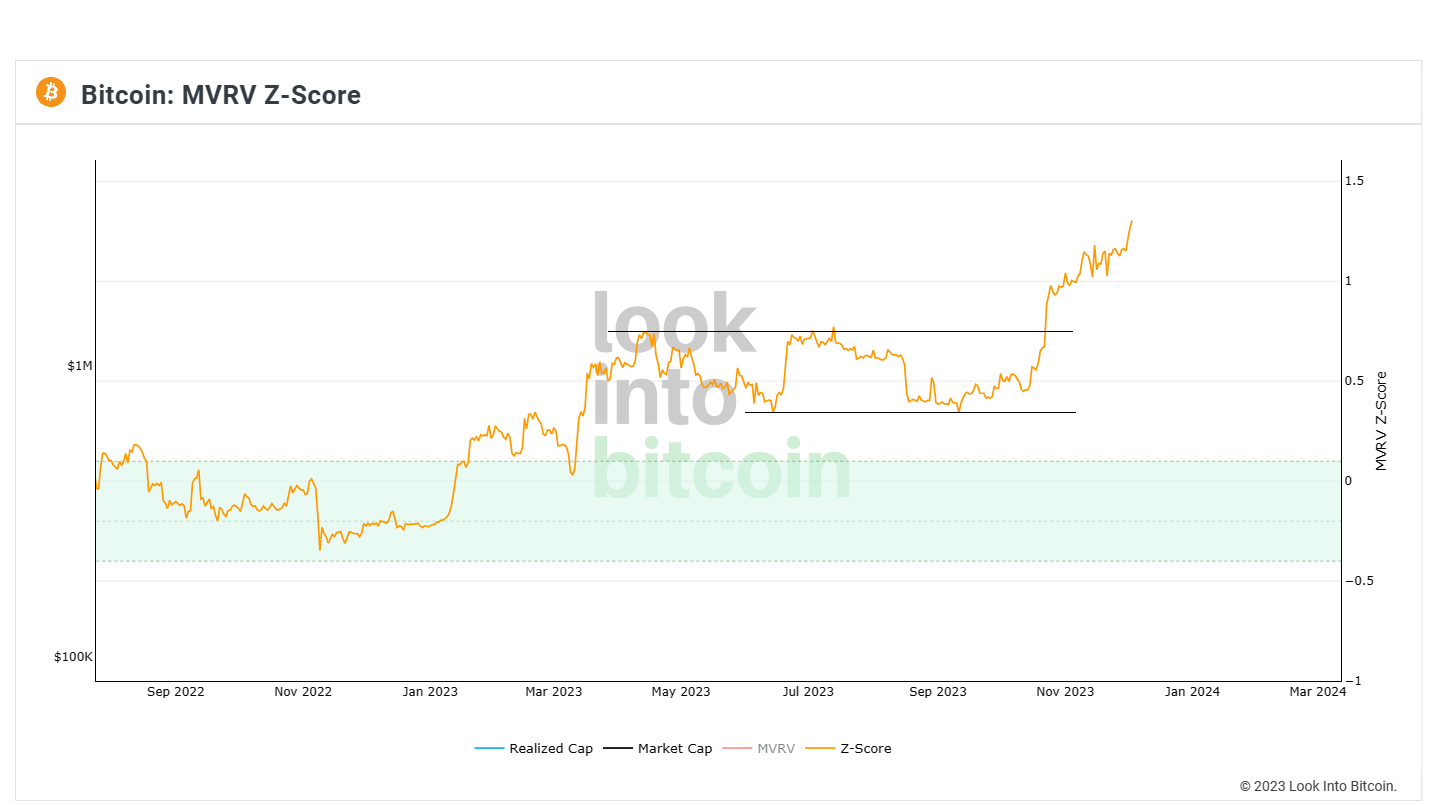

Zooming in the yearly trend is up.

Cryptocurrencies

Due to tax reasons and convenience I trade crypto ETF / certificates and cryptorelated stocks through my stockbroker.

Bitcoin is the leader. Ethereum has not started running much yet.

If the ETH/BTC ratio do not reverses strongly soon it could indicate that Bitcoin is about to move strongly.

Solana (SOL) has been strong, as well as Avalanche (AVAX). Some laggers I like are Chainlink (LINK) and Polkadot (DOT). However if they don’t outperform Bitcoin, there are no resons to hold them over Bitcoin, other than to decrease risk.

The past week Bitcoin has been strong. Microstrategy (MSTR) and Coinbase (COIN) have been the strongest cryptorelated stocks over the last year. Last cycle (Four year cycle / presidential cycle) most gains were made in cryptominers if I remember correctly. Not a few hundred percent but thousands.

Bitcoin has a large market cap. Cryptorelated companies have much smaller market caps and could increase or decrease in value at a higher pace.

Here are some of the charts I am looking at at the moment:

They seem to gap up at the moment before the market open.

MicroStrategy weekly

Coinbase weekly

If this COIN/MSTR ratio chart holds up it favors COIN.

Bitfarms

Massive volume and close near weekly high. I interpret this as strength.

Cleanspark

Massive volume and close near weekly high.

DMG Blockchain

High volume and close near weekly high.

Plan

Bitcoin usually runs first, then the rest while it consolidates and then runs again. My plan is to allocate more capital towars Bitcoin and Bitcoin related stocks when Bitcoin is strong. I also plan on trading around my positions and rotating between different instruments.

Bitcoin ETF (weeks away?) and Ethereum ETF approval or disapproval can be catalyst in either direction. I might sell some if the market overreact (eg. extends above from the weekly EMA 10).

My plan is to scale out of crypto when the MVRV Z-score is above 6 and after the Bitcoin halving, expected to be in April 2024.

Worst case

I will exit if the market turns down and Bitcoin can not hold above the weekly moving averages.

Thanks for reading!

Disclaimer: I have positions in all of the metioned securities and I may buy or sell at any time. I am not an investment advisor. The content on this website is for informational and educational purposes only, and that no mention of a particular security constitutes a recommendation to buy, sell, or hold that or any other security.